Netflix is a streaming service that provides a wide range of movies, TV shows, and documentaries to its subscribers. The company has been a major player in the entertainment industry for years, and its stock has been a popular investment choice for many investors. In this blog post, we will explore the Netflix stock and its performance, as well as the unique intersection it occupies between the realms of finance and technology.

Understanding Netflix Stock

Netflix is a publicly traded company, which means that its stock is available for purchase on the stock market. The company’s stock is listed on the NASDAQ stock exchange under the ticker symbol NFLX.

Features

Netflix stock fintechzoom buy or sell

Here are some of the features of Netflix stock:

Performance

Netflix stock has been a top performer in recent years, with a strong track record of growth and profitability. The company’s stock has outperformed the broader market, with a return of over 500% in the past five years.

Volatility

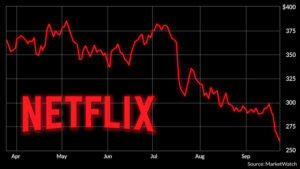

Like all stocks, Netflix stock is subject to volatility. The stock can experience significant price swings in response to news or events that affect the company or the broader market.

Valuation

Netflix stock is currently trading at a high valuation, which means that the stock is relatively expensive compared to its earnings. This can make the stock more risky for investors, as it may be more susceptible to price declines if the company’s earnings growth slows down.

Final Note

Netflix is a popular streaming service that has been a major player in the entertainment industry for years. The company’s stock has been a popular investment choice for many investors, with a strong track record of growth and profitability. However, like all stocks, Netflix stock is subject to volatility and can experience significant price swings in response to news or events that affect the company or the broader market. If you’re considering investing in Netflix stock, it’s important to do your research and understand the risks involved.